Table of Contents

- Executive summary

- Why artificial intelligence matters in modern finance

- Core AI techniques applied to finance

- High-impact use cases

- Data requirements and feature engineering

- Model validation, explainability and metrics

- Responsible AI and security considerations

- Implementation roadmap and integration patterns

- Reproducible mini case studies (annotated examples)

- Regulatory positioning and governance frameworks

- Measuring business impact and ROI proxies

- Future trends and research directions

- Conclusion and recommended next steps

- Further reading and technical references

Executive summary

Artificial Intelligence in Finance is fundamentally transforming the industry, moving from a niche technology to a core driver of competitive advantage. This guide provides a comprehensive overview for financial professionals, focusing on a governance-first approach to implementation. We explore core AI techniques, high-impact use cases from risk management to algorithmic trading, and the critical importance of data, model validation, and ethical considerations. By adopting a structured, reproducible, and responsible framework, financial institutions can unlock the full potential of AI while mitigating risks and ensuring regulatory compliance. This article serves as a roadmap for navigating the complexities of AI adoption, from initial proof of concept to full-scale production deployment.

Why artificial intelligence matters in modern finance

The financial sector operates on data, and the volume, velocity, and variety of that data have exploded. Traditional analytical methods are no longer sufficient to extract meaningful insights from this deluge. Artificial Intelligence in Finance matters because it provides the tools to process vast datasets in real-time, identify complex patterns, and automate sophisticated decision-making processes. Key drivers for its adoption include:

- Enhanced Efficiency: AI automates repetitive, high-volume tasks in areas like compliance, reconciliation, and customer service, freeing up human capital for higher-value activities.

- Superior Risk Management: Machine learning models can identify subtle signals of fraud, credit default, and market risk far more effectively than rule-based systems.

- Competitive Differentiation: Firms leveraging AI can develop more accurate trading strategies, offer hyper-personalized customer experiences, and bring innovative products to market faster.

- Alpha Generation: By analysing alternative data sources and executing complex strategies, AI helps asset managers and traders uncover new sources of investment returns.

Core AI techniques applied to finance

Several branches of AI are particularly relevant to financial applications. Understanding these core techniques is essential for identifying the right tool for a specific business problem.

Predictive modelling and time series methods

Predictive modelling is the bedrock of quantitative finance. Modern AI extends classical statistical methods with powerful, non-linear models. Deep learning architectures like Long Short-Term Memory (LSTM) networks and Transformers are exceptionally skilled at capturing complex temporal dependencies in financial time series data, such as stock prices, interest rates, and volatility. These models are used for everything from forecasting market movements to predicting loan defaults.

Natural language processing for financial text

Finance is filled with unstructured text data, including news articles, regulatory filings, earnings call transcripts, and social media sentiment. Natural Language Processing (NLP) enables machines to read, understand, and interpret this language. Techniques like sentiment analysis can gauge market mood, while topic modelling can extract key themes from thousands of documents. Advanced models like BERT (Bidirectional Encoder Representations from Transformers) provide contextual understanding, enabling sophisticated applications like contract analysis and automated report generation.

Reinforcement learning for decision systems

Reinforcement Learning (RL) is a paradigm where an agent learns to make optimal decisions by interacting with an environment and receiving rewards or penalties. In finance, this is directly applicable to dynamic problems like algorithmic trading and portfolio management. An RL agent can learn a trading strategy that maximizes returns while managing risk, adapting its behaviour as market conditions change without being explicitly programmed with fixed rules.

High-impact use cases

The application of Artificial Intelligence in Finance spans the entire value chain, from the front office to the back office.

Risk modelling and stress testing

AI enhances risk modelling by capturing complex, non-linear relationships that traditional models miss. For credit risk, machine learning algorithms can analyse hundreds of data points—including alternative data—to produce more accurate probability of default (PD) scores. For market risk, AI can simulate sophisticated stress-test scenarios, helping institutions understand their exposure to extreme events.

Fraud detection with anomaly detection

AI-powered anomaly detection systems are a cornerstone of modern fraud prevention. Instead of relying on predefined rules, these models learn the “normal” pattern of behaviour for a customer or system. They can then flag any transaction or activity that deviates significantly from this baseline in real-time, such as unusual spending patterns or suspicious login attempts, with a much lower false-positive rate than legacy systems.

Algorithmic trading and execution optimisation

In algorithmic trading, AI is used to develop, test, and execute trading strategies. Machine learning models can identify fleeting predictive signals from market data and news feeds. Reinforcement learning is used to optimize trade execution, minimizing market impact and transaction costs by learning the best way to place large orders over time.

Customer experience and personalization

AI is reshaping how financial institutions interact with their clients. AI-driven chatbots provide 24/7 customer support, while robo-advisors offer personalized investment advice at scale. By analysing customer data, banks can offer tailored product recommendations and customized financial planning, significantly improving client engagement and loyalty.

Back office automation and reconciliation

Robotic Process Automation (RPA) combined with AI is streamlining back-office functions. AI can automate complex tasks like trade reconciliation, invoice processing, and compliance checks (e.g., Anti-Money Laundering). This not only reduces operational costs but also minimizes human error and improves auditability.

Data requirements and feature engineering

The performance of any AI model is fundamentally limited by the quality and relevance of the data it is trained on. For financial applications, this means ensuring data is clean, accurate, and available in a timely manner. Beyond traditional market and transaction data, institutions are increasingly leveraging alternative data sources, such as:

- Satellite imagery to track commodity supplies.

- Web scraped data for product pricing and demand.

- Social media sentiment to gauge public opinion.

- Geolocation data to analyse retail foot traffic.

Feature engineering—the process of creating relevant input variables for a model—remains a critical step. It requires deep domain expertise to transform raw data into signals that have predictive power.

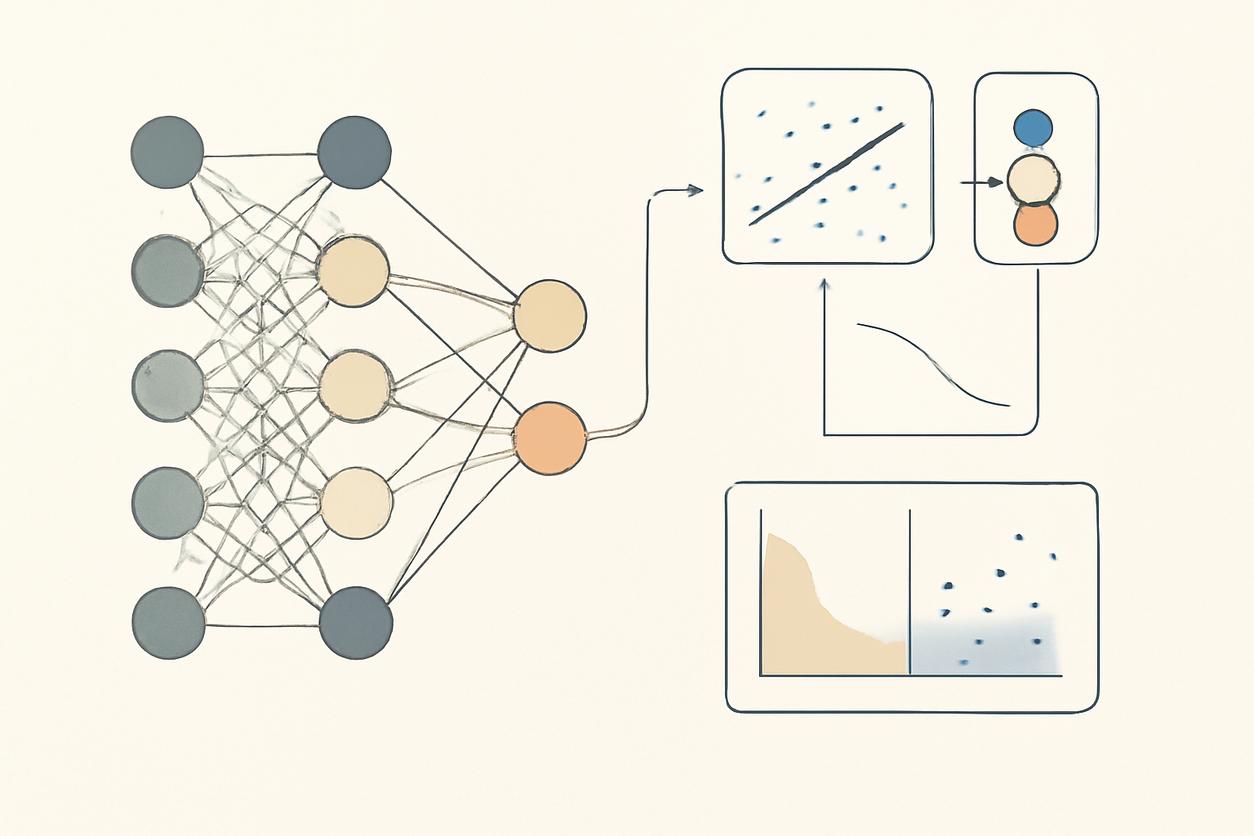

Model validation, explainability and metrics

In a highly regulated industry like finance, a model’s prediction is not enough; we must understand *why* it made that prediction. This is the domain of Explainable AI (XAI). Techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) help demystify “black box” models by showing which features contributed most to a given outcome. Robust model validation involves more than just accuracy metrics. It includes backtesting against historical data, stress testing under different scenarios, and assessing fairness to ensure the model does not produce biased outcomes. Financial-specific metrics, such as the Sharpe ratio, maximum drawdown, and Value at Risk (VaR), are essential for evaluating models used in trading and risk management.

Responsible AI and security considerations

Implementing Artificial Intelligence in Finance carries significant responsibilities. A governance-first approach is crucial to address key ethical and security challenges. This includes ensuring fairness by actively identifying and mitigating biases in data and algorithms, which could lead to discriminatory outcomes in lending or hiring. Transparency is another cornerstone, requiring clear documentation and explainability for all models. Data privacy must be protected through techniques like federated learning and differential privacy. Finally, AI systems introduce new cybersecurity vulnerabilities, such as model inversion or data poisoning attacks, which require specialized security protocols. For a deeper dive, consult this Responsible AI guide.

Implementation roadmap and integration patterns

A successful AI strategy requires a clear roadmap that bridges the gap between technical experimentation and business value.

Proof of concept to production steps

A phased approach minimizes risk and builds momentum. The typical journey includes:

- Problem Definition: Clearly define the business problem and success metrics.

- Data Exploration and Feasibility: Assess data availability and quality to determine if the problem is solvable with AI.

- Proof of Concept (PoC): Develop a small-scale model to demonstrate technical viability.

- Pilot Program: Test the model in a controlled, real-world environment with a limited user group.

- Production Deployment: Integrate the model into live systems with robust monitoring, MLOps pipelines, and governance oversight.

Common pitfalls and mitigation

Organizations often face similar challenges when implementing AI. Common pitfalls include poor data quality, a shortage of skilled talent, difficulty integrating AI models with legacy IT systems, and a failure to secure business buy-in. Mitigation strategies involve investing in a modern data infrastructure, fostering a culture of continuous learning, adopting a microservices architecture for easier integration, and starting with projects that have a clear and measurable ROI to build confidence.

Reproducible mini case studies (annotated examples)

To illustrate these concepts, consider two reproducible workflows:

| Case Study | Objective | Data Sources | AI Technique | Governance Check |

|---|---|---|---|---|

| Sentiment-Driven Stock Prediction | Predict short-term stock price movement | Real-time news feeds, social media data, historical price data | NLP for sentiment scoring, LSTM for time series forecasting | Use SHAP to identify which news events or keywords most influenced a specific prediction. |

| Credit Card Fraud Detection | Identify fraudulent transactions in real-time | Transaction history, customer metadata, merchant information | Unsupervised Anomaly Detection (e.g., Isolation Forest) | Regularly audit the model for demographic bias to ensure fairness across customer segments. |

Regulatory positioning and governance frameworks

The regulatory landscape for AI is evolving rapidly. Regulators are increasingly focused on model risk management, fairness, and explainability. Financial institutions must establish strong internal governance frameworks to oversee the entire AI lifecycle. This includes creating a cross-functional AI review board, maintaining a comprehensive model inventory, documenting all modelling decisions, and ensuring a human-in-the-loop for critical applications. Proactively aligning with emerging principles from regulatory bodies ensures that AI adoption is not just innovative but also sustainable and compliant.

Measuring business impact and ROI proxies

The value of an AI initiative must be quantifiable. Measuring the Return on Investment (ROI) of Artificial Intelligence in Finance can be direct or indirect. Direct metrics include cost savings from automation, revenue uplift from personalized marketing, or alpha generated from trading strategies. When direct measurement is difficult, ROI proxies can be used. These include metrics like improved customer satisfaction scores (NPS), reduced time to decision (e.g., for loan applications), or lower false-positive rates in fraud detection, all of which are strong indicators of business value.

Future trends and research directions

The field of AI is constantly advancing. Looking ahead to strategies for 2025 and beyond, several trends are poised to impact finance:

- Generative AI: Large Language Models (LLMs) and other generative tools will be used for creating synthetic data for model training, drafting sophisticated market commentary, and enhancing customer service interactions.

- Federated Learning: This technique allows models to be trained across multiple decentralized data sources (e.g., different banks) without the data ever leaving its source, addressing privacy concerns.

- Quantum Computing: While still in its infancy, quantum computing holds the potential to solve complex optimization problems in portfolio management and risk analysis that are intractable for classical computers.

Conclusion and recommended next steps

Artificial Intelligence in Finance is an undeniable force for transformation, offering unprecedented opportunities for efficiency, risk management, and growth. However, realizing this potential requires more than just technical expertise. A successful strategy is built on a foundation of robust governance, a commitment to responsible AI principles, and a clear focus on solving tangible business problems. By adopting a structured, validated, and explainable approach, financial leaders can confidently navigate this new landscape. The recommended next step is to identify a high-impact, low-complexity use case to build a proof of concept, demonstrating value and building organizational momentum for broader AI adoption.

Further reading and technical references

To continue your exploration of artificial intelligence and its application in the financial industry, we recommend exploring the resources available at Pinnacle Future. For a detailed analysis and technical specifications, you can also access our latest report by requesting a Whitepaper download.